In this scheme of Post Office Scheme 2024, husband and wife can get the benefit of up to 27000 every month from the account, here we have given complete information about Post Office Scheme 2024 online registration, Benefits, Eligibility and how to invest

Post Office Scheme 2024: Friends, you are also looking for this scheme of Post Office, where you are getting good returns on investing in Post Office RD Scheme, if you are husband and wife, then we have found a way to earn from home. Let us tell you that many types of savings schemes are run by the post office, out of which this is Post Office Scheme.

Through the Post Office Monthly Income Scheme (POMIS), up to 27000 can come every month from the account of husband and wife, it depends on your investment and you get more interest based on how long you keep your money. With this you can earn a lot, today we are going to tell you about this Post Office Monthly Income Scheme.

Post Office Scheme 2024

The post office of India brings a good scheme for the common families, through which people can earn a huge amount by investing and they get to see almost no return and the post office promises them in a way that your money is in this scheme, as long as you keep investing in it, your income keeps increasing.

Why is there a post office? Through the Post Office Monthly Income Scheme, husband and wife can earn up to 27000 every month at a fixed time, where they have to invest for 5 years and after that they get to see good returns every month at a fixed time.

With the post office scheme, you can invest for 5 years, where on the basis of interest in these schemes, you also get to see good returns every month, it has proved beneficial for the husband and wife.

| Feature | Details |

|---|---|

| Eligibility | Indian Citizen, Adult or Minor (through Guardian) |

| Account Type | Single or Joint (Max 3 account holders) |

| Minimum Investment | ₹ 1,000 |

| Maximum Investment | Single Account: ₹ 9 Lakhs, Joint Account: ₹ 15 Lakhs |

| Interest Rate | 7.40% per annum (payable monthly) |

| Investment Period | 5 years |

| Early Withdrawal Penalty | Before 1 year: 0% interest, 1-3 years: 2% penalty, 3-5 years: 1% penalty |

Post Office Monthly Income Scheme interest rate and limit

Post Office Monthly Income Scheme is a scheme run by the government, by investing in it you can also make a good source of income and there is no worry of risk. Talking about this scheme, you are given an interest rate of up to 7.4% per annum, even you can get to see almost no risk, your money is going to be very safe, you have to invest under this scheme for 5 years.

If you invest in it through a single account, then you can invest up to 9 lakhs, while when we talk about joint account, then you can enjoy its interest rate by investing up to 15 lakhs and that too every month, the whole method of how to apply for this scheme of post office is told.

Post Office Scheme Benefits

There are many benefits in this scheme of Post Office Scheme, which we have mentioned below:

- This is a government scheme, as far as the money is very safe in it.

- By getting a fixed amount every month, you can plan your expenses better.

- TDS is not deducted on the income received from this scheme, although it comes under the purview of income tax.

- In this, you can invest income from Rs 1,000 to Rs 9 lakh according to your need.

- Through this scheme, an investment of 5 years is made, within this time period your money gets matured.

- After this you can invest, through this scheme you can organize every month through interest.

- Along with this, you can easily transfer the earned money to your savings account.

- Under this scheme, you can open more than one account in the post office in your own name.

- You can nominate the name of any person in the family in this account so that the benefits of this scheme will be given to the nominee after the investor.

- This scheme is completed for 5 years. If you want to take full advantage of this scheme, then you can start the facility for another 5 years.

Eligibility for Post Office Monthly Income Scheme

- The benefit of Post Office Monthly Income Scheme will be available only to the citizens of India.

- The benefit of this scheme will not be given to any foreign person.

- Any adult can avail the benefit of this scheme.

- If you want to give the benefit of this scheme to a minor person, then you can start this scheme instead.

When the minor person turns 18, he can avail the benefit of this scheme. After this, whenever the minor wants to keep the account in his name even after becoming an adult, then his application process has to be completed.

Post Office Monthly Income Scheme

The benefits of Post Office Monthly Income Scheme can be availed by only one account holder, but the maximum amount that can be deposited in the account of its account holder is up to Rs 9 lakh.

Secondly, the benefit of this scheme can also be availed by joint account holders i.e. in which there are 2 or 3 account holders. In this, it is now necessary to include a maximum amount of Rs 15 lakh in the joint account.

How to invest in Post Office Scheme?

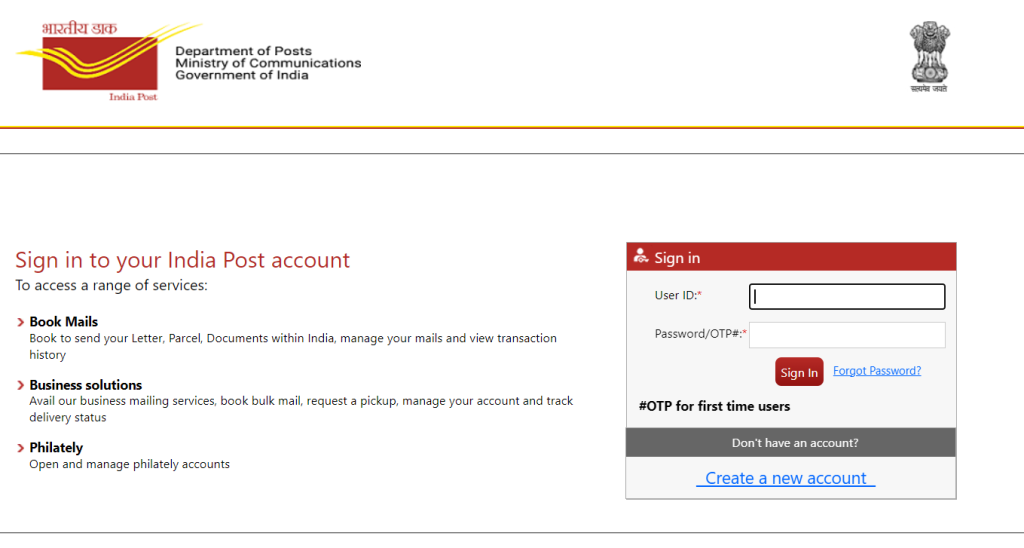

It is very easy for the beneficiary to invest in Post Office Monthly Income Scheme (POMIS), for this you can go to the nearest post office and fill the form.

In this, you have to submit your identity card, address proof and passport size photo, once the account is opened, you can do it through cheque or through demand and draft.

Post Office Monthly Income Scheme, which is considered safe and beneficial for investment by every family, not only provides you regular income but also ensures the safety of your money.

Before investing in this, you must evaluate your financial situation and goals and remember that you should maintain a balance between different types of investments which is also profitable.

How to fill the form in Post Office Monthly Income Scheme?

This is a scheme in which you cannot fill the form online like other schemes, for this you should go to the nearest post office and apply for Post Office Monthly Income Scheme (POMIS) scheme.

General Information:

- Scheme: Select “Monthly Income Account (MIS)” under the “Name of Scheme” section.

- Account Name: Enter your full name as per your ID proof.

- Father’s/Husband’s Name: Enter your father’s or husband’s name (depending on your situation).

- Date of Birth: Enter your date of birth in DD/MM/YYYY format.

- Address: Enter your complete permanent address.

- Mobile Number: Enter your active mobile number.

Account Details:

- Deposit Amount: Enter the amount you want to deposit (minimum Rs.1,000).

- Nominee Details (Optional): You can nominate someone to receive the account balance in case of your demise. Provide their name, address, and relationship to you.

Existing Account Details (if applicable):

- If you already have a Post Office Savings Account, mention the account number and the Post Office branch where it’s held.

Declaration and Signature:

- Read the declaration carefully and sign at the designated place.

- Get the form attested by a witness (someone who knows you) if required.

Current Interest Rates:

Duration (in Years): 1, Interest Rate: 5.50%

Duration (in Years): 2, Interest Rate: 5.50%

Duration (in Years): 3, Interest Rate: 5.50%

Duration (in Years): 5, Interest Rate: 7.6%

Details of Investment:

Single Account – the minimum amount to deposit is ₹ 1500 and the maximum is ₹ 4,50,00.

Joint Account – the minimum amount of investment is ₹ 1500 and the maximum is ₹ 9,00,000.

Minor Account – the minimum amount of investment is ₹ 1500 and the maximum is ₹ 3,00,000.

Maximum Investment Limit:

Single Account: ₹4,50,000; Joint Account: ₹9,00,000; Minor Account: ₹3,00,000

Notes:

For instance, if an investor invests ₹ 1,00,000 for 5 years with a monthly interest of 6.60%. Fixed monthly income according to the post office MIS scheme will be ₹ 550.

The post office monthly income scheme for senior citizens is 6.6%.

The minimum lock-in period for the post office monthly income scheme 2021 is 5 years.

Sources And References

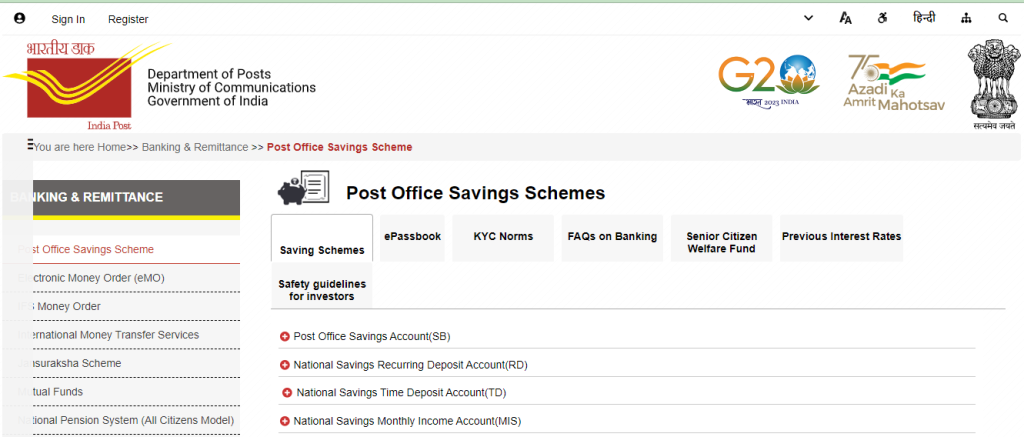

Guidelines > Click Here

Post Office Scheme 2024 Official Website Link

| Post Office Scheme 2024 Official website link | https://www.indiapost.gov.in/ |

Maharashtra